Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Discover the economic rationale behind shipping iron ore in bulk, the types of ships that dominate this trade, and the key maritime routes that connect the major mining regions with the steel mills thirsty for their loads along with coal in order to convert the iron ore into steel. We’ll also navigate through the challenges this industry faces, from stringent environmental regulations to port infrastructure constraints, and explore the paramount importance of safety measures in this colossal operation. Join us as we embark on a journey through the arteries of global trade, powering economies and shaping the modern world as we know it.

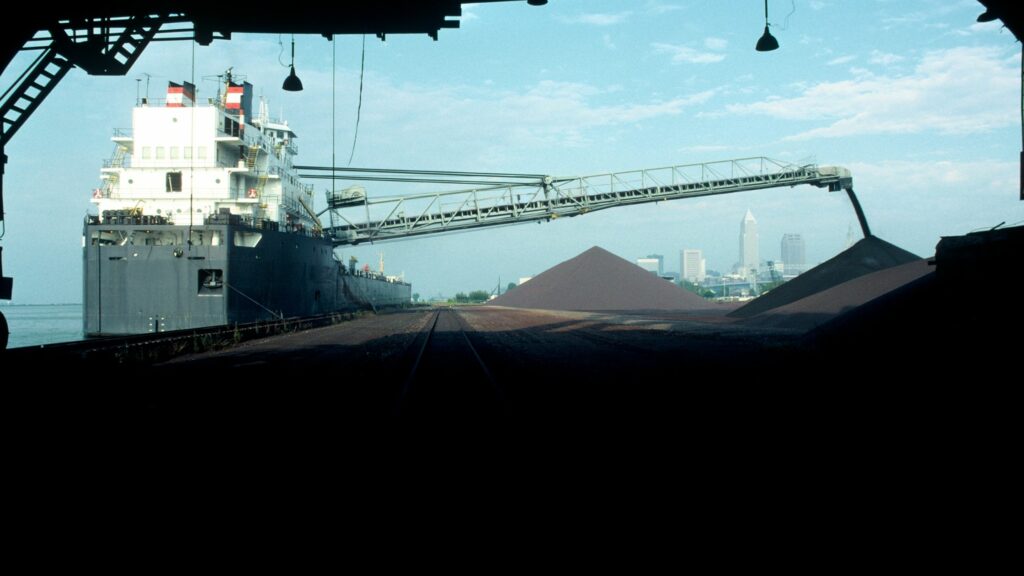

Bulk shipping of iron ore is a critical component of the global supply chain for the steel-making industry. This process involves the large-scale transportation of iron ore, a key raw material used in steel production, across oceans and seas in massive vessels known as bulk carriers. These carriers are specially designed to load, transport, and unload vast quantities of loose materials such as iron ore efficiently and cost-effectively.

The significance of bulk shipping in the iron ore trade lies in its ability to facilitate the movement of this essential commodity from major mining regions to steel mills worldwide, ensuring a steady supply to meet the global demand for steel. This mode of transportation is favored for its economic advantages, particularly for long-distance hauls, where it proves to be the most viable option in terms of cost and logistics. The efficiency and scale of bulk shipping operations are pivotal in maintaining the balance between the production and consumption of steel, underscoring its indispensable role in the global economy.

Shipping iron ore in bulk is primarily driven by economies of scale, which significantly reduce transportation costs. By moving large volumes of ore at once, shippers can achieve a lower cost per ton, making the transportation of iron ore more economical and efficient. This method also enhances safety and efficiency in transportation, minimizing the risk of accidents.

Bulk shipping allows for the iron ore to be handled less, reducing the chances of material loss or damage during transit. Furthermore, this approach aligns with the safety and efficiency protocols in maritime transport, ensuring that the iron ore reaches its destination securely while optimizing operational costs and time.

Economies of scale are crucial in the bulk shipping of iron ore, as they significantly reduce transportation costs. By shipping large quantities of ore in a single voyage, the cost per ton of cargo is drastically lowered. This efficiency not only renders bulk shipping an economically viable option but also ensures the steel production supply chain is cost-effective, meeting the global demand without excessive expenses.

The focus on safety and efficiency in the transportation of iron ore in bulk is instrumental in minimizing accidents. Bulk carriers, designed for the safe transportation of massive amounts of loose materials, mitigate the risk of cargo shift or spillage, which could lead to maritime accidents. Furthermore, efficient handling and streamlined operations reduce the risk exposure, ensuring the safety of both the crew and the environment.

Preparing iron ore for bulk shipping involves several key steps to ensure the material is safe and efficient to transport. Initially, the ore undergoes crushing to reduce it to a manageable size, making it easier to handle and load onto bulk carriers. Following this, screening separates the ore into different quality grades, ensuring that only material suitable for steel production is shipped.

Finally, adjusting moisture levels is crucial to prevent cargo liquefaction, a process that can compromise the stability of a ship. These preparation steps are essential for maintaining the integrity of the iron ore during transportation and for ensuring the safety of the shipping process.

Crushing the iron ore to a manageable size is a crucial initial step in the bulk shipping preparation process. Advanced crushers, such as gyratory or cone crushers, are employed to reduce the ore to sizes below 150 millimeters. This ensures the ore can be efficiently handled, loaded onto carriers, and transported without issue, streamlining the loading process and minimizing potential supply chain delays.

Following crushing, screening is essential to separate the iron ore into various quality grades. High-frequency vibrating screens are used to segregate the crushed ore into different size fractions, ensuring that only ore meeting the specific requirements for steel production is transported. This critical step guarantees the maintenance of high-quality standards and optimizes the steel manufacturing process.

The final preparation step involves adjusting the moisture content of the iron ore to prevent cargo liquefaction—a condition that can significantly affect a ship’s stability. The optimal moisture level varies but is typically around 8% to 10% for most iron ore types. This is achieved through a combination of dewatering techniques, such as filtration and centrifugation, and controlled water addition where necessary.

Proper moisture control is paramount for ensuring the safety of the vessel, its crew, and the cargo during the journey.

In the bulk shipping of iron ore, three main types of vessels are predominantly used, each tailored to different aspects of the trade. Capesize ships, the largest in the fleet, are designed for large, long-distance shipments that cannot pass through canal locks due to their size. Panamax vessels are slightly smaller, optimized for medium-sized loads capable of navigating through the Panama Canal, offering flexibility in routing.

Lastly, Very Large Ore Carriers (VLOC) represent the maximum capacity options, specifically built to carry the largest volumes of iron ore possible, making them the workhorses for high-volume routes. Each ship type plays a crucial role in the logistics of iron ore shipping, selected based on the specific requirements of the shipment, including volume, destination, and route constraints.

| Ship Type | Description | Average Carrying Capacity (DWT*) | Typical Routes | Notable Features |

|---|---|---|---|---|

| Capesize | Designed for large, long-distance shipments, unable to pass through major canals like Panama or Suez | 100,000 to 200,000 | Trans-oceanic routes (e.g., Australia to China) | Requires deep water ports |

| Panamax | Optimized for medium-sized loads, can navigate through the Panama Canal | 65,000 to 80,000 | Between Pacific and Atlantic oceans (e.g., South America to Asia) | Flexibility in routing |

| VLOC (Very Large Ore Carriers) | Built to carry the largest volumes of iron ore | Over 200,000 | Major iron ore shipping lanes (e.g., Brazil to China) | High efficiency for high-volume routes |

*DWT: Deadweight tonnage, a measure of how much weight a ship can carry.

Capesize vessels, named for their incapacity to navigate through the Suez or Panama Canals, necessitating a journey around the Cape of Good Hope or Cape Horn, are essential for large, long-distance shipments of iron ore. These ships are crucial for trans-oceanic routes, supporting the global iron ore trade by transporting vast quantities over significant distances.

Panamax ships, distinguished by their design to fit through the Panama Canal’s locks, cater to medium-sized loads. This attribute provides them with a strategic logistical advantage, allowing for more cost-effective and flexible routing options between major iron exporting and importing nations.

Very Large Ore Carriers (VLOC) stand as the titans of the sea, engineered to carry the utmost volume of iron ore. These vessels are indispensable for high-efficiency, high-volume transport needs, serving the busiest and most demanding segments of the iron ore shipping industry. Their deployment underscores the immense scale and critical nature of iron ore as a pivotal global commodity.

The bulk shipping of iron ore relies on several key maritime routes that connect major mining regions with global steel production hubs. The Australia to China route stands out as the most in-demand corridor, reflecting China’s immense appetite for iron ore to fuel its steel mills. Similarly, the Brazil to China passage caters to the need for lower sulfur content ore, offering a vital alternative source.

The South Africa to Europe route, while less voluminous, plays a strategic role in distributing iron ore to European steel manufacturers. These routes are fundamental to the efficiency and reliability of the global iron ore supply chain, ensuring the continuous flow of this essential commodity across the world.

| Route | From | To | Significance | Annual Volume (approx.) | Trends/Notes |

|---|---|---|---|---|---|

| Australia to China | Australia | China | High demand for iron ore in China’s steel industry | Over 700 million tonnes | Dominates the global iron ore trade; subject to fluctuations in bilateral trade relations |

| Brazil to China | Brazil | China | Lower sulfur content ore preferred for specialized steel-making | Around 250 million tonnes | Provides a critical alternative to Australian ore; impacted by logistical challenges and environmental policies |

| South Africa to Europe | South Africa | Europe | Strategic distribution to European steel manufacturers | Less than 100 million tonnes | Important for diversifying supply and enhancing the European steel industry’s competitiveness |

The Australia to China route is pivotal, catering to the high demand for iron ore in China’s expansive steel industry. This corridor plays a critical role in transporting large quantities of iron ore, which are essential for fueling China’s ongoing infrastructure and urban development initiatives.

The Brazil to China shipping lane is distinguished by its delivery of lower sulfur content ore, a key preference for specialized steel-making processes. This route ensures a consistent flow of this particular grade of iron ore to Chinese mills, showcasing the global iron ore trade’s capacity to meet diverse industrial requirements.

The South Africa to Europe route is integral for the strategic distribution of iron ore to European steel manufacturers. This link not only bolsters the European steel sector but also highlights the significance of South African mines within the global iron ore landscape, providing an essential connection in the international supply chain. This detailed table provides a comprehensive overview of the key routes for bulk shipping of iron ore, highlighting their significance, annual volume, and recent trends or notes that affect these vital maritime corridors.

The bulk shipping of iron ore, crucial for global steel production, encounters several challenges that influence its efficiency and sustainability. Environmental regulations on emissions and ballast water management impose significant operational hurdles, necessitating the adoption of cleaner, more sustainable practices by shipping companies. Furthermore, port infrastructure limitations in emerging markets can obstruct the seamless flow of iron ore shipments, leading to potential delays and increased operational costs.

The iron ore market is also vulnerable to fluctuations in demand, which can considerably impact shipping rates and the profitability of shipping routes. Addressing these challenges requires continuous adaptation and innovation within the bulk shipping industry to maintain the reliable and efficient transportation of this indispensable commodity.

Environmental regulations focusing on emissions and ballast water management are major challenges in the bulk shipping of iron ore. These rules compel shipping companies to adopt greener practices, driving the industry toward greater sustainability while also introducing significant operational costs.

Port infrastructure limitations within emerging markets pose critical obstacles to the efficiency of iron ore bulk shipping. Such limitations often result in delays and heightened logistical expenses, disrupting the seamless operation of the global iron ore supply chain.

Fluctuations in demand for iron ore can lead to significant volatility in shipping rates, affecting the economic viability of bulk shipping operations. Influenced by factors such as global economic health, steel production levels, and geopolitical events, these fluctuations necessitate agile adaptation by shipping companies to maintain market stability.

| Challenge | Specific Example | Impact |

|---|---|---|

| Environmental Regulations | IMO 2020 Sulphur Cap, requiring ships to use fuel with a sulphur content of no more than 0.5% | Increased operational costs due to the need for cleaner fuel or installation of scrubbers |

| Port Infrastructure Limitations | Limited depth at certain emerging market ports, restricting access for larger vessels | Delays and increased costs due to the need for smaller ships or transshipment |

| Fluctuations in Demand | COVID-19 pandemic leading to reduced industrial activity in 2020 | Volatile shipping rates, with a sharp decline followed by a rapid increase as demand rebounded |

By addressing these specific challenges with targeted strategies, such as investing in cleaner technologies, enhancing port infrastructure, and developing flexible operational plans, the bulk shipping industry can improve its resilience and efficiency in the face of these obstacles.

Ensuring safety in the bulk shipping of iron ore is paramount, given the scale and risks associated with maritime transportation of such a heavy commodity. IMO regulations play a crucial role in setting global standards for ship design and operational procedures, aimed at minimizing the risk of accidents and environmental harm. Regular inspections are vital to detect and rectify potential structural failures, ensuring that vessels are seaworthy and capable of safely carrying large cargoes.

Additionally, training for the crew on emergency procedures and the certification of their skills in safety and operations are indispensable for maintaining high safety standards. These measures collectively contribute to the reliability and safety of bulk shipping operations, safeguarding not only the cargo but also the lives of those onboard and the marine environment.

IMO regulations set forth essential guidelines for the design and operation of ships, crucial for the bulk shipping of iron ore and also for other meltas. These rules ensure vessels adhere to international safety and environmental protection standards, significantly reducing the risk of maritime incidents and safeguarding the marine environment.

Regular inspections play a pivotal role in the early detection and rectification of potential structural issues in bulk carriers. This preventative measure is key to maintaining vessel integrity, preventing accidents, and minimizing environmental risks.

Training for the crew on emergency procedures is indispensable for ensuring a high level of preparedness against unexpected situations. This comprehensive training empowers the crew with the skills needed to efficiently handle emergencies, protecting both the ship and its cargo.

Certification of the crew in safety and operations underscores their proficiency in conducting maritime operations securely and effectively. This certification is fundamental to upholding stringent safety standards in the bulk shipping of iron ore, ensuring all procedures are executed with precision and care. —

To enhance the Ensuring Safety in Bulk Shipping section with specifics and utilize a markdown table for clarity, the following table provides detailed information:

| Safety Aspect | Description | Specifics | Frequency/Examples |

|---|---|---|---|

| IMO Regulations | Global standards for ship design and operation | SOLAS for safety, MARPOL for pollution | Updated as needed; SOLAS amendments in 2020 |

| Regular Inspections | Preventative measure for structural integrity | Hull inspections, machinery checks | Annually and biannually; Special Surveys every 5 years |

| Training for Crew | Preparedness for emergencies | Firefighting, lifeboat drills, first aid | Initial training and periodic refreshers; drills conducted monthly |

| Certification of Crew | Proficiency in safety and operations | STCW for basic safety, specialized cargo handling | Valid for 5 years, with refresher courses required |